JA Finance Park & JA Finance Park Virtual

Capital One / Junior Achievement Finance Park equips students with the skills to make smart, lifelong financial decisions related to income, expenses, savings, and credit. The program includes 13 in-class lessons taught by teachers, culminating in an interactive budgeting simulation available in-person at a Finance Park facility or virtually. Each lesson offers additional extension activities and is tailored for middle and high school students. Middle-grade lessons follow a traditional classroom format, while high school students engage in a Project-Based Learning (PBL) model, allowing educators to choose the most suitable approach. (Grades 7–12)

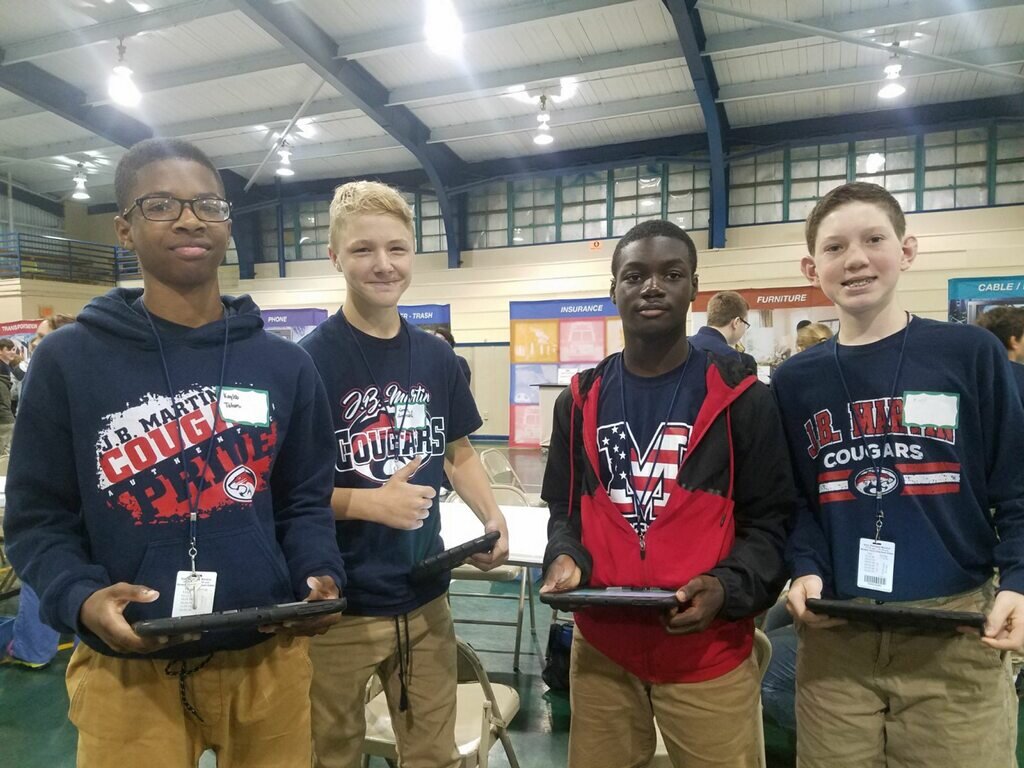

In the Finance Park simulation, students take on the role of an adult with a randomized life scenario, including a career, salary, family, and credit score. Guided by volunteers and JA staff, they create and manage a monthly budget based on their assigned persona.

JA Finance Park Advanced offers a deeper financial literacy experience specifically designed for high school students.

Want to learn more about JA Finance Park and JA Finance Park Virtual? Click here to view the program brief from JA USA.

Interested in bringing JA Finance Park or JA Finance Park Virtual to your classroom? Looking for volunteer opportunities? Visit the Request A Program page, contact an Impact Manager, or click the button below!

JA Finance Park Simulation

Teens don’t often think about paying a water bill, buying health insurance, or saving for retirement, but at JA Finance Park they do. The daylong visit to this simulated, fully interactive business park brings their in-class learning to life.

Students receive family scenarios, complete with job title, marital and family status, income, existing savings, and existing debt. Then they visit park businesses to explore their options and better understand the items based on their assigned family needs and then go shopping. They must purchase items to meet the needs of their family, such as insurance, clothing, transportation, housing, groceries, and childcare—without spending more than they earn.

JA Finance Park Virtual

During this hands-on, computer-based simulation, students are asked to manage a fictitious life situation. The details of their assigned life scenario include marital status, number of children, education background, employment, and income.

Given their career and family situation, students use banking services; pay for housing, transportation, utilities, groceries, and health care; contribute to charities; and budget for education expenses. They work to create and balance a personal family budget.